Best Tax Pro is Minnesota's premier tax consulting firm. Facing IRS tax problems? Turn to Best Tax Pro, LLC, for expert tax solutions. With over 130 years of combined IRS experience, our team offers expert guidance to ensure compliance and protect your rights. Our skilled Certified Tax Resolution Experts, Certified Public Accountants, and attorneys specialize in large debt IRS tax resolution, ending wage garnishments, releasing tax liens, and providing tailored tax relief options for your situation. From Minnesota and nearby areas nationwide, we offer trusted IRS relief assistance for a smooth and reliable resolution process. Choose Best Tax Pro, LLC, if you are having a hard time with the IRS.

Enrolled brokers (EAs) are The usa’s Tax Experts®. These are the one federally-certified tax practitioners who each specialise in taxation and have unlimited rights to represent taxpayers prior to The interior Income Service. These tax specialists have earned the privilege of representing taxpayers ahead of the IRS by possibly passing a three-element examination covering specific tax returns; enterprise tax returns; and representation, practice and course of action, or as a result of suitable experience for a previous IRS personnel.

The tax experts on this Listing have earned the privilege of symbolizing taxpayers prior to the IRS by either passing A 3-part evaluation covering person tax returns; company tax returns; illustration, exercise, and course of action, or by way of related practical experience as a former IRS worker. All enrolled brokers are subjected to some demanding track record Test done because of the IRS.

Normally, if you have intricate taxes that touch on one or more of the next conditions, you may take into consideration selecting a tax preparer or CPA:

. Should your tax preparer doesn’t supply e-file, it might be a sign the individual isn’t carrying out as much tax prep when you considered.

Quickest Refund Attainable: Get your tax refund from your IRS as speedy as feasible by e-filing and selecting to acquire your refund by direct deposit. Tax refund time frames will fluctuate. The IRS concerns over nine away from ten refunds in under 21 times.

If you choose this Professional’s not the very best healthy for you, remember to arrive at out to our Consumer Accomplishment Workforce so they can Focus on connecting you having a new pro. They’ll get again to you inside of just one to two enterprise times.

Homeowners insurance plan guideHome coverage ratesHome coverage quotesBest dwelling insurance companiesHome insurance policies and coverageHome insurance calculatorHome insurance reviews

When selecting a tax preparer, ask them with regards to their interaction choice. Some tax preparers desire talking about issues around the mobile phone or video clip while others will remedy simple concerns by IRS enrolled agent using electronic mail.

Business enterprise Tax Guarantee: If you employ TurboTax to file your online business tax return, you can be protected by a combination of our a hundred% correct calculations, maximum personal savings and audit assistance assures. Should you pay back an IRS or condition penalty (or curiosity) thanks to a TurboTax calculation error or an error that a TurboTax skilled made when acting for a signed preparer to your return, we are going to spend you the penalty and desire. You're accountable for having to pay any supplemental tax liability it's possible you'll owe. If you will get a larger refund or lesser tax thanks from An additional tax preparer by submitting an amended return, we'll refund the relevant TurboTax Live Organization federal and/or condition obtain cost paid out.

Your specialist reviews your return along with you and solutions any issues, guaranteeing your best outcome right before they file—one hundred% accuracy guaranteed.

A tax professional can perform a remaining critique of the return before you decide to file to make certain it’s 100% accurate, confirmed.

Homeownership guideManaging a mortgageRefinancing and equityHome improvementHome valueHome insurance policy

TurboTax Whole Service - Kinds-Centered Pricing: “Commencing at” pricing signifies the base value for one particular federal return (features a single W-two and one Kind 1040). Remaining price tag could change determined by your real tax condition and forms utilised or included with the return. Value estimates are provided just before a tax qualified beginning Focus on your taxes. Estimates are dependant on initial data you present regarding your tax scenario, which include sorts you upload to aid your specialist in planning your tax return and sorts or schedules we think You will need to file depending on That which you convey to us regarding your tax problem.

If authorised, your Refund Progress is going to be deposited into your Credit history Karma Funds™ Spend (checking) account typically inside 15 minutes after the IRS accepts your e-filed federal tax return and you might access your money on the internet by way of a virtual card.

Haley Joel Osment Then & Now!

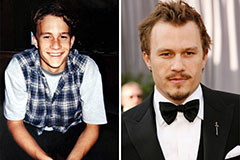

Haley Joel Osment Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!